New-to-Canada Mortgage

If you’ve immigrated to Canada, lived here for less than five years, and have suitable employment, you’re likely ready to buy a home. You probably have questions about qualifying for a newcomer mortgage option and understanding the process. At skipthebank.ca, we have the resources to help you secure a Canada newcomer mortgage.

From getting pre-approved for a newcomer mortgage in Canada to finalizing your mortgage once you’ve found a house, we’re your guide. Whether you’re interested in a newcomer mortgage program, wondering about mortgage payments, or want to know how your Canadian credit history or credit card use might affect your application, we’ve got you covered. Even temporary residents may be eligible for a newcomer to Canada mortgage program, including options with a lower newcomer mortgage down payment.

Purchase Property in Canada

For Citizens And Non-Citizens Alike

New-to-Canada

Purchase a Home in Canada

The Canadian real estate market is open to just about anyone living within or beyond its borders, including non-citizens. If you’re new to Canada and planning to settle down or looking for investment properties, this real estate market is perfect for you! There aren’t any restrictions on what type of property one can buy. This leaves you with plenty of opportunities depending on your needs and budget. Our team at Skip the Bank will cover all aspects, so don’t worry if something isn’t clear immediately. We’ll ensure you have everything you need and are all set to purchase your first home or property in Canada!

Our newcomer mortgage program Canada offers flexible options, even if you have limited Canadian credit history. We’ll guide you through every step, from understanding the current mortgage rates to managing mortgage payments tailored to your situation.

Get a Free Consultation

New-to-Canada

What is the New to Canada Mortgage?

The New to Canada mortgage plan is a financial initiative created especially for immigrants who wish to establish credit and lay the groundwork for a sound financial future. This mortgage for newcomers in Canada offers flexible options to help you with the purchase of residential property, whether you’re buying your first home or investing for the future.

At skipthebank.ca, we are kind and patient. We know that buying your first home in Canada may feel uncomfortable, but you’ve already taken many risks to immigrate! Our immigrant mortgage process allows you to understand every step of buying a home in Canada, even if English is not your first language. If you’re here on a valid work permit, or have recently upgraded your work permit, we can help you qualify—even if your credit score isn’t fully established yet. We also have a specialist at our office who speaks fluent Vietnamese and can join us for meetings to help translate.

FAQ

Answers to Our Most Frequently Asked Questions

01

Do I Need to be a PR to Qualify for a Mortgage in Canada?

No, you just have to have applied for Permanent Resident status.

02

What is the Minimum Down Payment Required for Newcomers?

- 10% – 5% from own resources.

- 5% can come from a gift from immediate family member.

03

What Documents do I Need to Provide for a New to Canada Mortgage Application?

- PR application

- 2 years of employment history information.

04

How can I Establish a Credit History in Canada as a Newcomer?

Get a cell phone and apply for a card.

Make purchases on your card or line of credit and then pay them off before the required date.

Advantages of the New to Canada Mortgage

Access To Homeownership

Newcomers to Canada now have the chance to purchase their first home here thanks to our financing mortgage plan.

Build Credit History

Our New to Canada mortgage plan can help you establish a credit history in Canada, which is essential for accessing financial products and services.

Flexible Options

Flexible mortgage alternatives are available through our New to Canada program to meet your individual demands and financial position.

No Credit History Required

You can qualify for our mortgage plan without a Canadian credit report or credit history.

Reasons to Choose Skip the Bank’s New to Canada Mortgage Plan

- Competitive Rates: You can save money by taking advantage of our competitive interest rates compared to your financial institution.

- Dedicated Support: From application to funding, our team of professionals is available to help you every step of the way.

- No Hidden Fees: We are transparent about our fees and don’t charge any hidden fees or prepayment penalties.

At Skip the Bank, we understand that purchasing a home is a significant milestone, especially for newcomers to Canada. That’s why we’re committed to helping you achieve your dreams of homeownership with our New to Canada Mortgage program. Apply now and start your journey to homeownership with Skip the Bank!

New to Canada

Real Mortgage Success Stories

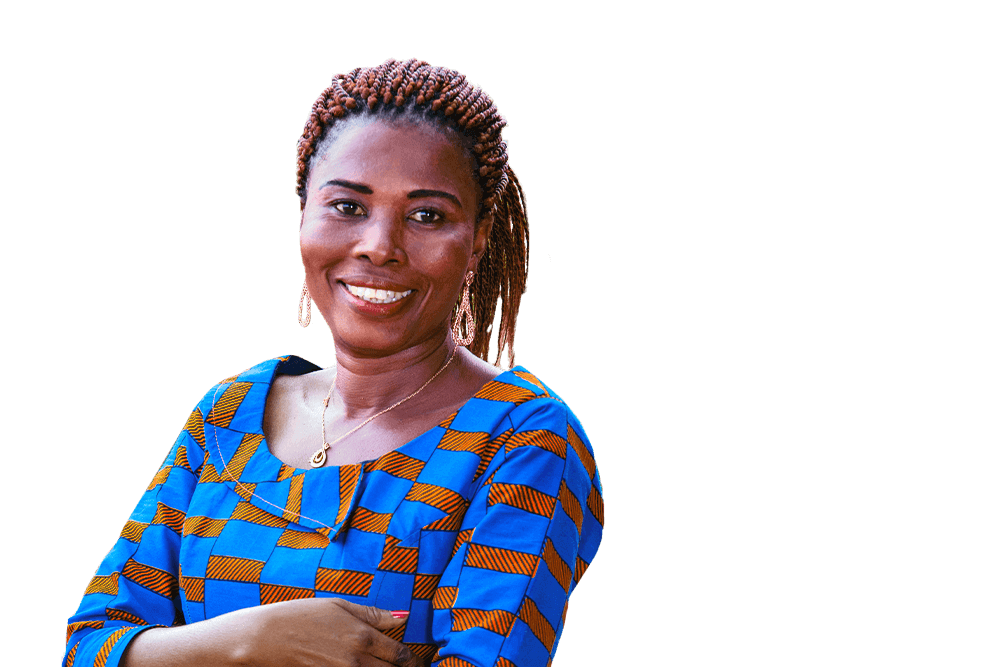

Letina and her two adult children had lived in Canada for only two years. They arrived from Ghana and worked hard to find jobs and were able to save $60,000 in cash. One of their dreams was to own a house as they were renting since they arrived. Language was a barrier but they had a friend who used The Mortgage Centre and knew English so they accompanied Letina to The Mortgage Centre for their first mortgage pre-approval meeting.

What was particularly helpful for Letina was that she was able to provide an application and income documents such as T4’s, pay stubs and letters of employment on-line through The Mortgage Centre’s secure web portal. When she arrived at her appointment with her friend, The Mortgage Centre was able to provide her with a pre-approval certificate and answer any detailed questions she had. Her friend acted as a translator. In two months Letina found a house with a minimum down payment and has started building equity in Canada through home ownership.

New-to-Canada Mortgage Resources

June 15, 2022

Reasons Why Working with the Right Mortgage Broker is Important

Who’s taking care of your biggest asset’s value – your home? With grumblings in the Toronto and...

September 30, 2019

Answers to Common Questions About Canada’s First-Time Home Buyer Incentive

The new First-Time Home Buyer Incentive allows eligible first-time home buyers, who have the minimum downpayment for...

May 14, 2019

Moving to Canada? Plan Ahead for Homeownership.

If you have a job awaiting you on Canadian soil, it’s possible to also secure the purchase...

Ready to Talk?

We’ll help you get the mortgage

that’s perfect for you.