The last few years in Canada have been nothing short of a fever dream. From the unexpected COVID-19 pandemic and nationwide lockdowns to the dramatic shifts in the housing market, Canadians have navigated a whirlwind of economic uncertainty. One of the most pressing issues to emerge during this time has been the volatility of interest rates. In this blog, we’ll break down the key factors that will influence the Bank of Canada’s upcoming rate announcements for the remainder of 2025.

The Impact of Inflation on Interest Rates

The Bank of Canada maintains an inflation control target of 2%, with an acceptable range between 1% and 3%. This target is central to its interest rate decisions. Although inflation is nearing the target range as of June 2025, we’re not quite there yet.

The Bank of Canada is constantly working to strike a balance between strengthening the economy and supporting the financial well-being of all Canadians. This is why the inflation rate plays such a significant role in setting the overnight lending rate. It serves as a tool to influence spending—either slowing it down to reduce inflation or encouraging it to stimulate growth.

Current Lending Rates from the Bank of Canada

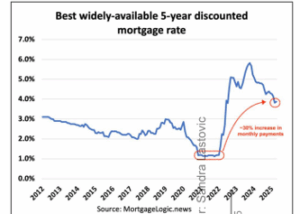

As of June 2025, the current prime rate stands at 4.95% for loans and lines of credit. This is a notable improvement compared to where we were less than a year ago, though still higher than the historically low rates seen during the pandemic.

The graph below shows past trends in 5-year discounted mortgage rates.

Over the last few years, the prime rate has been gradually decreasing as inflation comes down. The Bank’s goal here is to encourage consumer spending and stimulate economic growth by lowering borrowing costs—ultimately aiming to keep inflation under control.

So, What Does This Mean for the Rest of 2025?

Looking ahead, the Bank of Canada faces a complex economic landscape. While inflation is inching closer to target and economic growth remains steady, external factors—such as global economic conditions and trade policies—will heavily influence future monetary policy.

For Canadians, these dynamics (both domestically and internationally) suggest that borrowing costs may remain relatively stable in the short term. However, with ongoing conversations around tariffs and trade shifting weekly—if not daily—it remains challenging to predict how the Bank of Canada will respond in the months ahead.

Stay Informed

If you’re considering a first-time mortgage, renewing your current mortgage, or purchasing an investment or vacation property, staying informed about interest rates is essential. Follow us on Instagram, Facebook, or YouTube for real-time updates and expert insights as the rate environment continues to evolve.