A Boutique Brokerage with Options for Everyone

Since 1999, Our promise has always been to provide better advice, better rates, and better mortgages.

With a diverse team of specialists, we can help you at any stage of life. Whether you’re refinancing, a first-time home buyer, new to Canada, rest assured you’re in great hands with Skip The Bank.

Mortgage Brokers Guelph

Our Expertise

OUR TEAM

AMY VAN HOLST

Operations Manager

Mortgage Agent Level 1

Licence #M12002415

HEATHER FERGUSON

Special Projects & Private Lender Coordinator

Mortgage Agent Level 2

Licence #M17002898

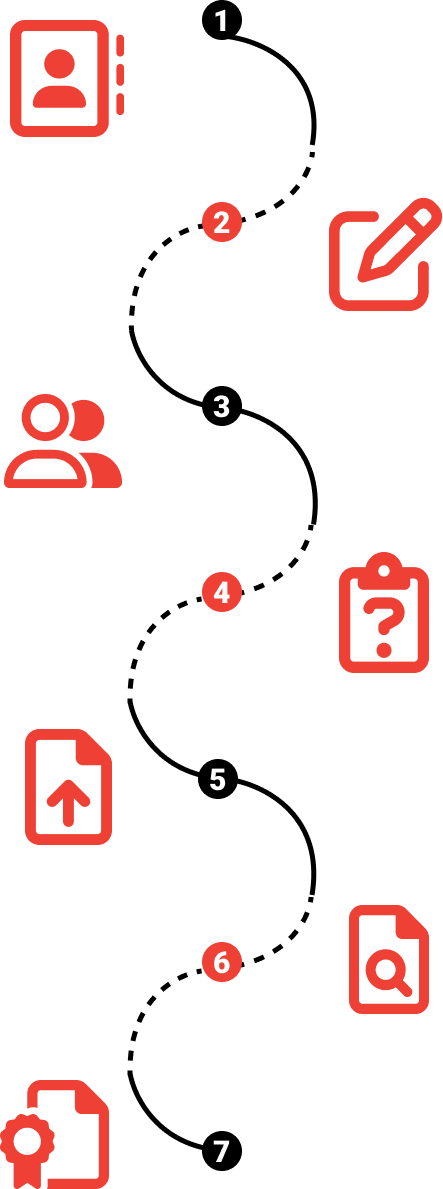

Our Process

How Does The Mortgage Centre Distinguish Itself From Other Banks or Brokerages?

1. Reach Out

Prospective clients can reach out by phone or fill out the contact form on our website.

2. Fill and Upload Documents

Upon contact, we guide individuals through the online mortgage application process. We’ll help you identify the documents you need and get them securely uploaded to the web portal.

3. Online Appointment

Conduct an initial online appointment to review goals, clarify provided documents, and discuss credit history. We also explore various scenarios, summarizing them in a follow-up email.

4.Ask About & Solve any Doubts

For those seeking advice, we offer a 30-minute session to answer questions.

5. Mortgage Submission

We confirm details via email and submit the mortgage for approval. Typically, within 3-7 business days, we secure mortgage approval and email all documents in advance of a 30-minute online appointment to review them.

6. Documentation Review

During the scheduled document review, we highlight crucial mortgage details, make final adjustments, and facilitate electronic signatures.

7. Closing Process

We coordinate the final mortgage details, including appraisal ordering, collecting any outstanding documents from borrowers, and communicating with the lawyer for a seamless closing process.

Ready to Talk?

We’ll help you get the mortgage

that’s perfect for you.

We’ll help you get the mortgage that’s perfect for you.